致力于为中小企业提供一站式商务综合服务

Committed to providing one-stop comprehensive business services for small and medium-sized enterprises

外资企业注册

Registration of foreign capital enterprise

以下为您详细介绍外资公司设立要求、申请文件清单、注册流程、申请时间程序及后续维护。

鼓励外商投资产业目录(2022年版)

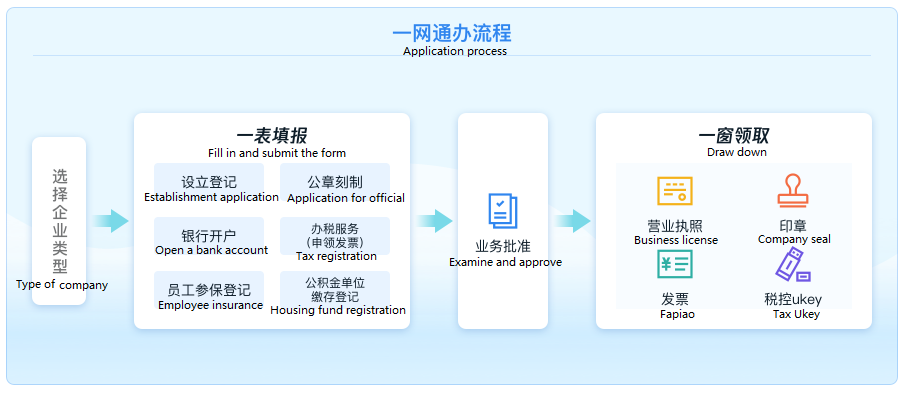

• 如企业经营涉及后置许可,需要到相关 监管部门办理备案或者许可证件才可开展业务

• 办理税务登记、税种核定等事项

• 办理银行开户(在自行选定的银行开立人民币基本账户、 外币账户或其他一般结算账户)

• 办理外汇登记(在上述银行代为办理企业对内直接投资登记、外汇资本金账户及资本金汇入登记)

• 企业按月按季度进行纳税申报户

• 按时进行年度工商年报及联合年报

• 按需求办理社保及公积金的登记及初始人员信息录入(有实际员工时需要)

如需快速了解,亦可以联系我们的业务顾问,我们的专业服务团队致力于支援企业踏出开设业务、处理税务、 办理各种相关手续及公司后续运营的每一步。

外资企业注册,外商独资企业,投资流程,行业限制,外资准入清单,公司设立流程,后置许可,银行开户,外汇登记,纳税申报,年度工商年报,社保公积金登记,申请文件清单,投资者主体资格证明,公司章程,公司任职人员证件,公司注册地址,法律文件送达委托书,个人身份公证,企业公证认证,外资企业注册,外资企业备案,投资项目限制类,负面清单,工商登记流程,商务部登记流程,税务登记,联合年报,社保登记,公积金登记,企业设立登记申请书,外资公司设立要求,外资公司申请文件清单,外资公司申请时间,投资负面清单,外商投资产业目录,五证合一,一照一码,开业后续事项,境外个人投资者

Foreign-funded enterprises are the most favored form of investors. A wholly foreign-owned enterprise (WFOE) is a limited liability company that is solely funded by a foreign investor and established with the approval of the people's government and performs the duties of the investor in accordance with the articles of association. It is run by the foreign party itself, making its own profits and bearing its own risks. The investors are foreign enterprises or individuals, including individuals or enterprises in Hong Kong, Macao and Taiwan.

Special Administrative Measures for Foreign Investment Access (2024)

Special Administrative Measures for Foreign Investment Access in Pilot Free Trade Zones (Negative List) (2021 edition)

Catalogue of Industries to Encourage Foreign Investment (2022 edition)

- Application for enterprise establishment registration (one according to one code)

- Articles of Association

- Investor qualification certificate

- Copies of certificates of employees of the enterprise (legal representative, executive director/chairman, director, supervisor, manager)

- Company registered address

- The power of attorney for the service of legal documents, the qualification certificate of the subject or the identity certificate of the natural person for the service of legal documents to the authorized person

There are two types of investor qualification certificates:

Foreign natural person investors

If the investor is an overseas natural person, it is necessary to sign and take photos in person at the market supervision Administration; Or if the natural person is abroad, it is necessary to handle the notarization or notarization certification documents of personal identity in a qualified law firm abroad; If the document is not in Chinese, the original translation of the document is required.

Foreign corporate investors

If the investor is an overseas enterprise, the enterprise needs to handle notarization or notarization certification documents at the local law firm; If the document is not in Chinese, the original translation of the document is required.

• If the business involves post-licensing, it is necessary to apply for the record or license to the relevant regulatory authorities before it can carry out business

• Handle tax registration, tax verification and other matters

• Open a bank account (open a basic RMB account, a foreign currency account or other general settlement account at a bank of your choice)

• Handle foreign exchange registration (handle inward direct investment registration, foreign exchange capital account and capital remittance registration on behalf of the above bank)

• Enterprises file tax returns monthly and quarterly

• Conduct annual business and joint annual reports on time

• Handle social security and provident fund registration and initial personnel information entry as required (required when there are actual employees)

For more information, you can also contact our business consultants, our professional services team is dedicated to supporting companies every step of the way to start a business, handle taxes, go through various related procedures and the subsequent operation of the company.

外资企业注册,外商独资企业,投资流程,行业限制,外资准入清单,公司设立流程,后置许可,银行开户,外汇登记,纳税申报,年度工商年报,社保公积金登记,申请文件清单,投资者主体资格证明,公司章程,公司任职人员证件,公司注册地址,法律文件送达委托书,个人身份公证,企业公证认证,外资企业注册,外资企业备案,投资项目限制类,负面清单,工商登记流程,商务部登记流程,税务登记,联合年报,社保登记,公积金登记,企业设立登记申请书,外资公司设立要求,外资公司申请文件清单,外资公司申请时间,投资负面清单,外商投资产业目录,五证合一,一照一码,开业后续事项,境外个人投资者

想了解更多,添加客服或留意为您解答

Learn more?Add me or leave a message